Learn US TAXES Filing Secrets with IRS APPROVED CONTENT and Start Your OWN PROFITABLE BUSINESS

Fine-tune your tax knowledge!

All resources you need to Obtain your tax preparer AFTR, Mantain EA and CPA status with CE Hours.

Starting at only

$297 per year

Fill Out This Form Below

And Start Your Journey!

By submitting this form you agree to receive emails related to products and services from Tax Group Pros . You can unsubscribe anytime .

HEY, ARE YOU TIRED OF ...

- Searching for a HIGH VALUE skill that doesn't require years of college expending or very expensive equipment just to get started?

- Being involved or investing in businesses that turned out having Low to near Zero Demand?

- Being overwhelmed with TONS of marketing and sales gurus that dont provide you with a robust business model and operational insights?

DO YOU WANT TO ...

- Possess a HIGH VALUE SKILL and ALSO BE ABLE TO SHOW ACREDITED HOURS UNDER YOUR NAME ?

- Have access to a HIGH DEMAND market ?

- Have a Profitable, Fast Growing Business ?

- Have BATTLE TESTED, IRS APPROVED Operational Insights and Knowledge about the Ins and Out of the Business you are getting into ?

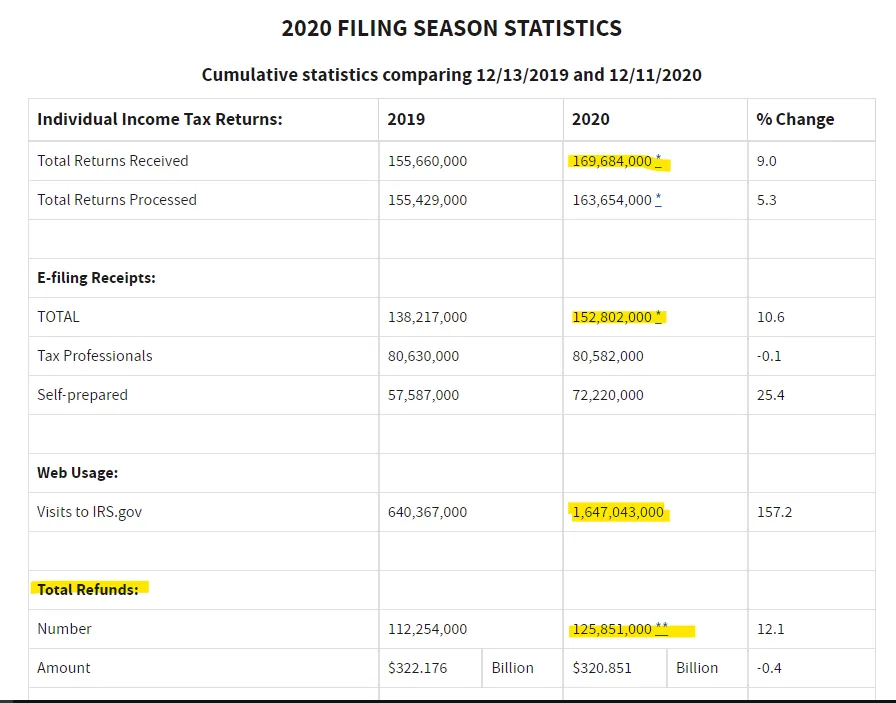

GET ACCESS TO A MARKET AS BIG AS ..

THE IRS NUMBERS CAN TELL YOU :

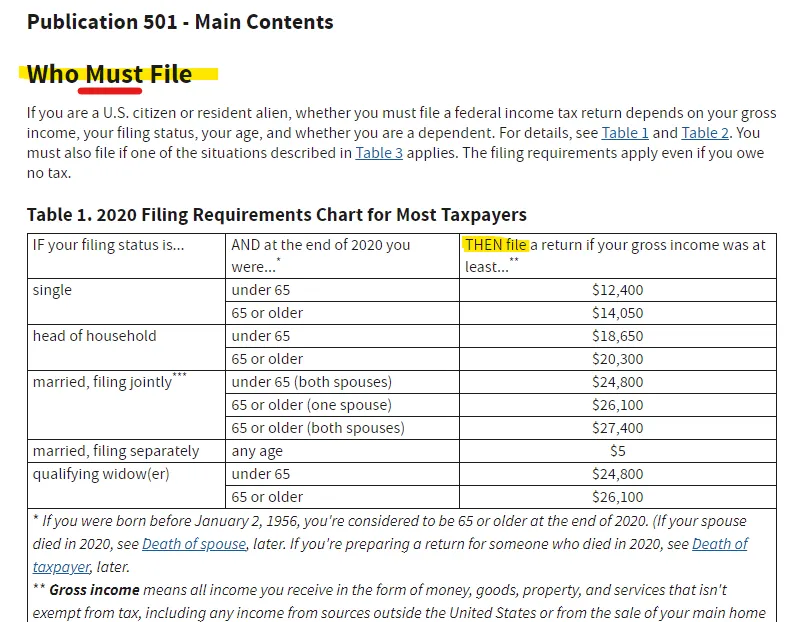

C1 - OFFICIAL SOURCE (IRS) :

More than 169 MILLION Individual Income Tax Returns

More than 152 MILLION E-Filing Receipts

More than US$320 BILLION in Tax Refunds

C2 - OFFICIAL SOURCE (IRS) :

NUMBERS DON'T LIE

AND COMMON SENSE NEITHER ...

ALMOST EVERYBODY

NEEDS OR MUST

FILE THEIR TAXES

Filing Taxes is ...

In Legal Terms

As Important As

Shopping Groceries this Weekend

By this time,

you must be figuring it all out ,

the demand for taxes related services is STRONG and WELL in this country,

as more and more Americans

and even foreign residents too

get in the job market

and are required to file their TAXES...

And thats not all ...

EVEN PEOPLE NOT REQUIRED TO FILE TAXES

MAY BENEFIT FROM DOING IT

Tax Refunds ... anyone ... ?

TGP UNIVERSITY

Brings You EVERYTHING YOU NEED To Get YOU Started on the Path of TAXES RELATED SUCCESS!

Tax education courses inside Tax Group Pros University

will teach you the laws that govern

how taxes work and

will get you acreddited hours within the

Internal Revenue Service (IRS) system .

With this information,

you will be able not only to make educated decisions

about your finances and taxes,

but you will be ready to help others

and even start your own tax agency!

These IRS-Approved courses offer

a legal understanding of taxes and the law,

which is essential for tax professionals to be aware of

in order to best serve their clients.

Equip yourself with the must-have skills

that will enable you to provide tax preparation services!

Get into the Business of Helping people

AVOID paying more taxes than they have to.

GET READY FOR THIS :

- Be able to work remotely

- Choose your own schedule

- Be self-employed

- Interact with different people

- Help families do their taxes (including yours)

- Be an important part of your clients success !

And this :

GET YOUR CONTINUING EDUCATION CREDITS

INCLUDED IN THIS PACKAGE !

Continuing Education(CE) Credits ?

The IRS offers a credit for individuals who successfully complete qualified Continuing Education courses. The length of the course determines the amount of time that can be credited to ones account .

Inside TGPU you will have acces to IRS Approved Continuing Education courses and required tests .

FOCUS, LEARN, PASS THE TESTS

AND ADVERTISE YOUR WINS ...

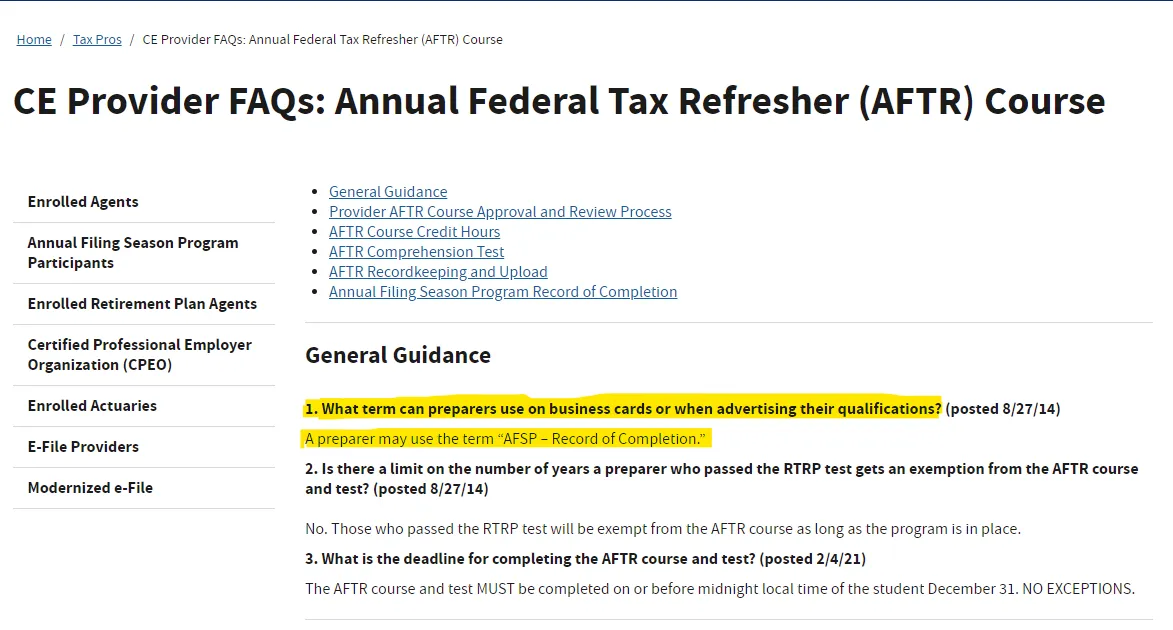

DISPLAY YOUR RECORDS OF COMPLETION

You will be able to display your

Records of Completion

in your Business Card

and/or when advertising your Qualifications !

C3 - OFFICIAL SOURCE (IRS) * :

GET YOUR CE CREDITS !

Get Access to our IRS Approved CE Provider partner site,

which will allow you to:

- Record Your Viewing Hours

- Take The Tests

- And Get IRS CE HOURS Record of Completion

FOR ALL the CE Courses Hours you get in this offer.

ALL INCLUDED!

In order to get your CE credits records of completion, you will need to obtain a PTIN first, which you will be able to do online for a small fee (this is not covered by this offer) within the IRS system, have watched the entire length of your selected course, and have passed the course test.

*In order to display the "AFSP - Record of Completion" Status as shown in the figure, you will need to have your PTIN ready, have completed and passed the test of the AFTR Course (6 hours), and have completed and passed the test of another 12 hours (including 2 hours of Ethics) of the CE courses included in our offer. All the CE Courses Completion Tests are covered by this offer.

TGP UNIVERSITY

Brings You EVERYTHING YOU NEED To Get YOU Started on the Path of TAXES RELATED SUCCESS!

These IRS-Approved courses offer

a legal understanding of taxes and the law,

which is essential for tax professionals to be aware of

in order to best serve their clients.

Equip yourself with the must-have skills

that will enable you to provide tax preparation services!

BENEFITS YOU GET WITH YOUR CE COURSES

CE CREDIT TESTS ARE INCLUDED IN THIS PACKAGE !

For People Just Starting Out

Get Everything you possibly need to get the understanding of how the tax system works, UP-TO-DATE legal procedures and requirements . Be able to start helping people with the right knowledge and CE accreditation under your name .

For Tax Preparers

Get your IRS CONTINUING EDUCATION credits to solidify your knowledge gains and experience . Get IRS APPROVED, high quality, updated content in order to get the things done the way the IRS wants to for this current year and all benefits available .

For Enrolled Agents (EA) / CPA

Maintain your EA/CPA status by getting your Continuum Education Credit Hours . Get the 2022 Refresher Course, 2021 updates and more CE content. Are you only interested in the Refresher Courses? We have a program for that too .

GET YOUR RECORDS OF COMPLETION

AND WIN RECOGNITION FOR YOUR EFFORTS

In order to get your CE credits records of completion, you will need to obtain a PTIN first, which you will be able to do online for a small fee (this is not covered by this offer) within the IRS system, have watched the entire length of your selected course, and have passed the course test.

TGP UNIVERSITY MODULES

MORE THAN 40 HOURS OF CONTINUING EDUCATION CONTENT

TGP UNIVERSITY PROGRAM

MODULE # 1

Tax Law + 2022 AFTR Refresher

Receive the 2022 Annual Federal Tax Refresher Course, the 2021 Ethics Circular 230, the 2021 Best Practices, and much more within this module . Learn how the system works as a whole.

MODULE # 2

Household Module

Get immensely important, IRS approved knowledge about taxes laws related to Family Income, Healthcare, Retirement, Tax Rules for Education Expenses, Travel, Entertainment, Divorce, Bankruptcy and more.

MODULE # 3

Jobs Module

Help yourself and others save more and pay less in taxes by understanding what counts as taxable income, benefits that come with being employed / self-employed and the impacts of the Tax Cuts and Jobs Act to Individual Returns.

MODULE # 4

Business Module

Business related taxes are a huge issue in the business world. Businesses have to pay for income, sales, property and other types of taxes. Come inside and get a better understanding of companies finances, its requirements, and the deductions available for them.

MODULE # 5

Extras (Crypto Tax / Foreign Banks)

Receive some important, extra-ordinary knowledge with courses like the 2021 Cryptocurrency Tax Strategies course and 2021 Understanding Foreign Bank Account Reporting Obligations.

TGP UNIVERSITY BONUSES

BONUS#1

TAX PREPARATION BUSINESSES - NON CE COURSES

Tax Preparation Business related Courses for you to able to suceed in the tax preparation services area . How to deal with your clients in a efficient, responsible manner, how to get high - ticket clients, and so much more!

MEET THE TEACHERS

GET ACCESS TO THE TAX PROFFESIONALS

Dr Bart A. Basi

Founder and Senior Advisor at

The Center for Financial, Legal & Tax Planning, Inc .

Attorney at Law

Certified Public Accountant (CPA)

Roman Basi

President at The Center for Financial,

Legal & Tax Planning, Inc.

Certified Public Accountant (CPA)

Mark J. Kohler

Certified Public Accountant (CPA)

Attorney at Law

Best - Selling Author

DAVE HALL

TANYA BABER

DOUG STIVES

AND MUCH MORE !

Hey, you !

Rashad here,

Just wanted to say "Hi" again and ask you

what will stop you for getting this program now ?

I've looked at every angle of this, and this program

pays itself in so many ways :

Whether it ...

Enables you to help yourself or your family prepare taxes ...

Makes you the taxes expert with colleagues or friends ...

Whether it could be the thing that gives you that promotion ...

Whether this is the thing that will start and/or help your business ...

this program will add value to your life .

It changed my life in a positive way, and I know it will change yours too for the better...

Best Regards,

Rashad Williams_

TAX GROUP UNIVERSITY

Terms and Conditions | Privacy Policy | Member Login

This site is not a part of the Facebook website or Facebook Inc. Additionally, this site is not endorsed by

Facebook in any way. FACEBOOK is a trademark of FACEBOOK, Inc.

IMPORTANT: Earnings and Legal Disclaimers

We don't believe in get-rich-quick programs. We believe in hard work, adding value and serving others. And that's what this programs is designed to help you do. As stated by law, we can not and do not make any guarantees about your own ability to get results or earn any money with our program . Your results in life are up to you. Nothing on this page or any of our websites or emails is a promise or guarantee of future earnings. If you have questions, email info@tgppro.com.

Copyright © Tax Group Pros . All Rights Reserved .